Story by Kevin Williams, CNBC

(I have a deep hatred of these scammers. I would love to see them all tossed into an oubliette somewhere hot, humid with lots The only way to protect ourselves, our loved ones, our friends is through knowledge and sharing what we know about these scammers.)

“Hey, how are you?”

“Hey, how’s your sore back?”

“Sorry, I’m running a little late; I’ll meet you for dinner at 6:15.”

If you have been on the receiving end of an increasing number of seemingly random and innocuous texts like those, you aren’t alone. And it wasn’t a wrong number. Online scammers are increasingly turned to “wrong number” message tactics, aided by AI, to trick phone users into providing access to personal information and financial accounts.

Ann Nagel, who works at a college in suburban Chicago, received a text that was convincing enough to make her think she should respond.

“I had actually thought it was from one of my members from an organization I run in town. It had me going for a few seconds,” Nagel said.

But she quickly realized it was a scam when the texter asked Nagel to send a Vanilla Visa gift card and scratch off the back numbers. Nagel quickly ended the text exchange.

“They are a tricky bunch of thieves, no doubt,” Nagel said.

Steve Grobman, chief technology officer at McAfee, says there is usually much more going on than just an innocent wrong number. The texters have multiple objectives by sending seemingly harmless missives to your phone. First, he says, the scammers — most often based overseas — are validating that the mobile number is active and the person is willing to engage and respond.

“They are adding the number to their database so they can target it surgically for future scams,” Grobman said. They can note in their files that this person could be a potential future victim even if the initial exchange doesn’t bear fruit. And if a person, phone company, or wireless carrier blocks a number, the scammers will move onto the next one, as has been happening during the recent wave of toll fine scams.

“Once the first objective is met, what they are trying to do is build some sort of relationships,” Grobman said, and he added that these criminals are often working as part of well-funded, well-organized criminal enterprises.

Scammers are willing to put in the work to reach their ultimate aim, which is parting you from your money, and Grobman says the highest yield scams are ones that involve forging a personal relationship that can be turned into a form of what is known as a “pig butchering scam.

Life savings, retirement accounts are the ultimate target

Long, draw-out, text scams — sometimes including a romantic element — are chasing someone’s life savings or retirement account. “Because there is such a large payoff, it is worth the extra time required to grow it,” Grobman said.

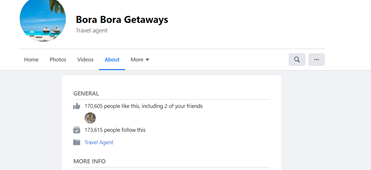

AI is making these once time-consuming, laborious scams more efficient and easier to target people. AI can help criminals zero in on area codes for tailored texts, comb through social media profiles, and build out family networks.

“Wrong number” texts, in particular, are increasing because of the confluence of data dumps over the past few years combined with AI’s availability.

“This allows scammers to create highly believable scams, higher levels of engagement, and higher levels of victims falling for scams,” Grobman said. “Consumers need to be very careful. You really shouldn’t engage,” he added.

But that can be difficult for some because psychology is as much a part of the text scammer’s toolkit as AI and software. “Their effectiveness taps into something much deeper: our human need for connection,” said Malka Shaw, a New Jersey-based psychotherapist in private practice who has seen a rise in text scam victims in her practice.

Shaw says the long shadow of Covid continues to casts its darkness over this problem. “We’re living in a time where loneliness has reached epidemic levels. Especially in the wake of the pandemic, so many people feel disconnected and unseen,” Shaw said. People who have endured trauma in their past or are lonely can find themselves more drawn into connections that can come via text.

“Their cognitive biases will be down, and they’ll say, ‘I need that contact.’ That is how they get you in,” Shaw said.

AI in the hands of criminals makes it easy and fast to scan social media profiles for people who might seem lonely and then connect them to a phone number.

‘Mini-ransoms’ for locked social media accounts

Even if the innocuous scams don’t yield a big pig-butchering payday, they can still be worthwhile. Eder Ribeiro, director of global incident response at TransUnion, says emptying someone’s life savings is the primary goal, but hackers can still derive secondary value from the texting.

“Data is money,” Ribeiro said, adding that even if they only get a name and phone number, such info can be sold on the dark web, or perhaps they’ll get enough data to sell on the dark web and crack your email. In some cases, a text scammer will be able to extract enough of a response to track down the person’s social media accounts and lock them out and people are willing to pay to reclaim their accounts.

“We see people pay smaller amounts of money to gain access to their social media,” Riberio said, adding that those “mini-ransoms” can be between $200-$800, not the huge payday the hacker was seeking, but still something.

“They can find out stuff about most people and use it for extortion, fraud, or the information can be aggregated for the data and sold,” Ribiero said.

Dustin Brewer, senior director of proactive cybersecurity services at BlueVoyant, says the best advice for recipients of unwanted texts is to ignore the messages. Do not initiate a response and mark them as spam. These simple steps empower people by making a firm decision while removing the text from their inbox.

“And doing so makes me an undesirable target for the scammer, and no follow-up messages occur for the most part,” Brewer said. Marking it spam could help others by alerting your messaging app that this message is potential bait for a scammer. Some messaging apps use this type of reporting to detect future scams and protect other users, Brewer said.

But TransUnion’s Ribiero says, for now, expect the texts to continue. “The frequency is increasing because it works, and if you get results, you keep doing it,” he said.

This article was originally published on NBCNews.com